PlanSource Payroll Integration

OnboardCentric is able to transfer completed new hire information directly into your PlanSource HCM platform.

Your organization must first have an account with PlanSource to ensure that this integration can be turned on in your OnboardCentric account. Once this information is set up and confirmed, the following details will help you transfer a new hire from OnboardCentric to PlanSource HCM.

For a new hire to be eligible for transfer, they must have the following forms completed:- Federal W4

- Direct deposit form

Once a new hire is eligible for transfer, a Payroll Admin will then navigate to the user’s account and click on the Payroll tab.

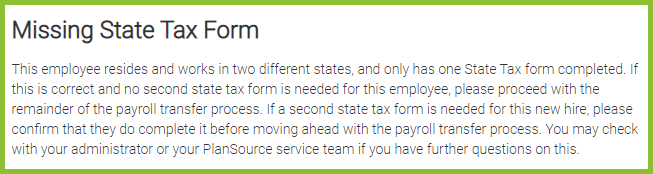

If the employee has not completed a state tax form, the user will see the following screen. Due to logic limitations, a requirement for a state tax form cannot be implemented. Therefore, it is the user’s responsibility to determine if a state tax form is needed before sending the employee to PlanSource. The payroll admin can transfer the employee with or without a state tax form.

The staff member will enter information into the required fields to correctly correlate with this particular new hire.

- The values in the various drop down options in this section are populated with your unique values from your organization’s PlanSource HCM account.

- The data in these drop down options is updated every 12 hours.

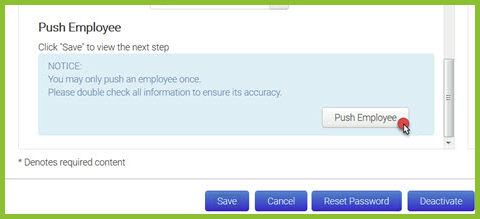

If there are no errors, the payroll admin must click the Push Employee button to confirm the action.

If there is an error, the staff member will see the details on the screen. The system will not send the information, but the information entered may be saved.

- If the error is on the Payroll tab, this will allow the staff member to update/re-enter the information in question and try the transfer again.

- If the error is on a form, the form may be manually assigned to the new hire again so that they may correctly complete the form. At that time, the staff member can attempt the push again.

- If an error is discovered after the new hire has been transferred to PlanSource HCM, any changes to the new hire’s information must be made within PlanSource HCM.

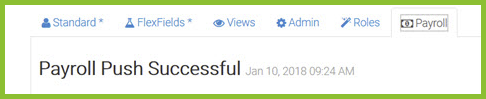

New hires may only be pushed to PlanSource once. The payroll tab will become locked after a successful push and show the date and time.

Data Listing

Now that the Plansource integration is live, a new Data Listing will be available for Admin use. The Data Listing is called, PlanSource Payroll Statuses, and the purpose is to show each attempt and the outcome of the attempt.

- Navigate to Work With > Data Listings

- In Category, select Administrative

- In Report, select PlanSource Payroll Statuses

General Questions

- “What if I have sent my employee to PlanSource but the information is wrong?”

- If an employee was pushed successfully but the information sent was incorrect or needs updating, you must log directly into your PlanSource HCM software and make those corrections in that employee’s account.

- “Why is a state tax form not required for the push of an employee?”

- Various states possess various rules for the requirement of a state tax form. Some states do not have a tax form, others do, and some others require a reciprocal agreement for tax forms. Certain tax forms are based on where you live and others on where you work. Because of these variables, ExactHire and PlanSource allow your team to determine whether a state tax form is needed for each given new hire.